Homeowners often wonder if fixing a sagging slab or cracked walls will make buyers think twice. The short answer: it depends on how the repair is done, what buyers see, and the local market vibe. Below we break down the factors that decide whether foundation repair becomes a value‑add or a value‑drain.

Foundation repair is a structural remediation process that stabilizes or restores a building's load‑bearing base, often using piers, slab jacking, or wall anchoring. Properly executed, it stops further movement, protects the interior finish, and can extend a home’s useful life by decades.

What exactly does foundation repair involve?

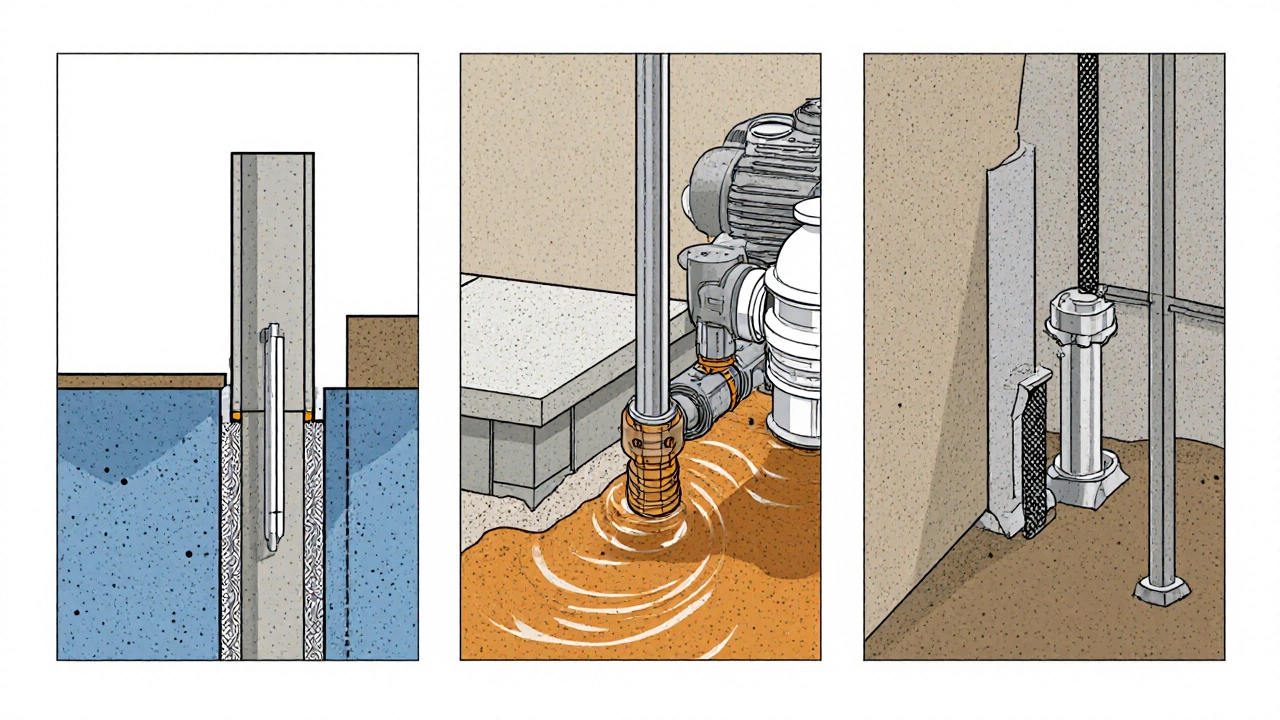

Typical repairs fall into three buckets:

- Underpinning: Installing concrete piers or steel push‑pins to reach stable soil layers.

- Slab jacking: Pumping a cement‑based grout underneath a sunken concrete slab to lift it back into place.

- Wall anchoring: Adding steel braces or carbon‑fiber straps to reinforce bowing or cracked foundation walls.

Each method has a cost range, a lifespan, and a visual footprint. The less intrusive the method, the easier it is to convey a positive story to buyers.

How real‑estate appraisers treat foundation work

Appraisers follow the USPAP (Uniform Standards of Professional Appraisal Practice). They look at two things:

- Condition adjustment: A property with a known defect gets a downward adjustment unless the defect is fully remedied.

- Improvement cost vs. market value: If the repair cost exceeds the market‑wide increment it creates, the net effect is negative.

In practice, an appraiser will request documentation - a structural engineer’s report, permits, and before‑and‑after photos - to verify that the repair was done to code. Without paperwork, the appraiser may still assume a risk and keep the deduction.

When foundation repair can actually boost your home’s market price

Here’s a quick checklist of scenarios where buyers see the repair as a plus:

- **Permitted work** - Local council approved, with a clear chain of approvals.

- **Professional sign‑off** - A licensed structural engineer provides a final inspection report.

- **Visible, clean finish** - No unsightly pits, grout seams hidden, and interior walls undamaged.

- **Stable soil conditions** - The repair addresses the root cause, not just the symptom.

- **Comparable sales with no foundation issues** - In a market where “good foundation” is the norm, the repaired home aligns with peers.

In these cases, the repair often recoups 80‑100 % of its cost in added sale price, especially in high‑demand suburbs where buyers value certainty.

When foundation repair may actually lower perceived value

Conversely, a repair can raise red flags if any of the following apply:

- **No permits** - Even if the job looks solid, the absence of official paperwork signals risk.

- **Partial fix** - Only the most visible cracks are addressed, leaving underlying settlement untreated.

- **Visible construction debris** - Exposed piers, unsightly grout seams, or charred anchor plates.

- **High repair cost relative to home price** - If you spent $30,000 fixing a $150,000 house, buyers may view the expense as a sign of larger hidden problems.

- **Market anxiety** - In slower markets, any hint of structural work can give buyers negotiating power to request a price cut.

In these situations, expect a 5‑15 % discount on the asking price, even after the repair is complete.

Cost‑vs‑value analysis - a simple calculator

The table below shows a rough scenario for a 2,500 sq ft house in Auckland. Adjust numbers for your locality, but the pattern holds across most English‑speaking markets.

| Scenario | Repair method | Typical cost (NZ$) | Estimated value increase | Net impact |

|---|---|---|---|---|

| Full underpinning with permits | Piers & steel plates | 25,000 | +22,000 | -3,000 |

| Slab jacking (no permits) | Grout lift | 12,000 | +5,000 | +7,000 |

| Partial wall anchoring only | Steel straps | 8,000 | +2,000 | +6,000 |

| DIY epoxy crack fill | Epoxy kits | 1,200 | +0 (no change) | -1,200 |

Notice how the only scenario that truly adds net value is one where the repair cost is lower than the market‑wide perceived benefit. High‑cost, high‑visibility fixes can still be worth it for safety, but they may not boost the price linearly.

Steps to protect or increase home value after foundation repair

- Obtain permits and keep all paperwork. Store copies in a folder that travels with the house.

- Hire a licensed structural engineer. Their stamped report validates that the issue is resolved.

- Document the process. Before‑and‑after photos, contractor invoices, and inspection certificates help buyers feel confident.

- Address secondary damage. Repair cracked drywall, uneven floors, and moisture‑stained finishes so the home looks flawless.

- Disclose proactively. Include the repair details in the property listing; transparency often prevents last‑minute renegotiations.

- Update the property appraisal. Request a new valuation after the work is finished - many appraisers will adjust the value upward if the repair is documented.

Common myths about foundation repair and resale value

- **Myth:** All repairs automatically lower price. Fact: Properly executed, permitted repairs usually maintain or slightly improve value.

- **Myth:** Buyers can’t see the repair work. Fact: Buyers and inspectors can see inconsistencies; hidden work can raise suspicion.

- **Myth:** You should hide the repair history. Fact: Full disclosure builds trust and often prevents costly renegotiations after an inspection.

- **Myth:** DIY fixes are just as good. Fact: Without a professional report, lenders and insurers may still view the home as high‑risk.

Bottom line - does foundation repair decrease home value?

If you follow the best‑practice checklist - permits, professional sign‑off, clean finish, and thorough documentation - the repair will **not** decrease your home’s market price. In many cases it adds a modest bump, especially when the alternative is a lingering defect that would have forced a discount. The only time you see a value drop is when the repair is shoddy, undocumented, or overly expensive compared with the overall price of the house.

Frequently Asked Questions

Will lenders lower a mortgage offer if my house had foundation repair?

Most lenders require a recent appraisal. If the appraisal shows the repaired foundation is stable and the work is documented, the loan amount stays the same. Lack of permits or a missing engineer’s report can trigger a lower offer or a request for additional underwriting.

How long does a foundation repair stay on the property record?

In New Zealand the work is recorded on the building consent register and appears on the title history. It stays there indefinitely, but it also serves as proof of a resolved issue, which can be a selling point.

Can I get a tax deduction for foundation repair?

Generally, repairs that maintain the property’s condition are not deductible. However, if the repair is part of a larger renovation that adds value, the cost may be added to the property’s cost basis for future capital gains calculations.

What should I tell my real‑estate agent about the repair?

Give the agent a copy of the engineer’s report, the council consent, and before‑and‑after photos. Ask the agent to highlight the repair as a safety upgrade, not a flaw, in the listing description.

If I sell within a year of repair, will I recoup the cost?

Usually not fully. Short‑term buyers often expect a discount for recent work. Expect to recover 40‑60 % of the expense if the market is strong; less in a buyer‑saturated market.

Written by Fletcher Abernathy

View all posts by: Fletcher Abernathy